The FIFA World Cup 2022 Qatar brought global crowds to a fever pitch.

The lead-up to this year’s cup was marred by controversy. In fact, prior to the tournament, 1 in 4 Canadians and 1 in 4 Americans stated they planned on reducing their consumption of the 2022 FIFA World Cup.

Now, a month out from the tournament's conclusion, we surveyed US and Canadian residents to find out what impact brand sponsors of the FIFA World Cup generated among fans.

Whenever we measure sponsorship impact, step 1 starts with the consumer.

Here’s everything we know about soccer fans in North America.

FIFA’s popularity in the US and Canada

Soccer probably doesn't come to mind when you think of each country’s most popular sport. And you’re right, the NHL and NFL have won the popularity contest in Canada and America respectively.

But, soccer has a growing place in the hearts of North Americans, and FIFA as a property provides a pretty good way for brands to reach an engaged group of consumers

In the US, more than 96MM or 4-in-10 residents have engaged with the FIFA World Cup in the past year. What’s more, after a dip in engagement over the past 3 years, engagement levels for Qatar returned to Russia 2018 levels.

While in Canada similar levels of engagement are observed, with 9.6MM or 4-in-10 residents having engaged with the FIFA World Cup over the last 12 months. The nation’s engagement really picked up steam throughout Canada’s qualification process, also reaching engagement levels on par with that of Russia 2018. Canada’s participation in the Word Cup lead to strong engagement given it’s diverse population.

Painting a picture of the FIFA fan

As with any sponsorship strategy, it’s important for brands to really understand who they are trying to reach. By unpacking some core demographic data, we can better understand target efficiency and measure the true sponsorship impact when all is said and done.

Using the SponsorPulse Insights Platform, we’re able to get a detailed snapshot of FIFA-engaged consumers across markets.

Here’s a breakdown of FIFA fans in the US:

43% of Americans aged 13-64 have engaged in the past 12 months

56% among engaged are Male

39% are between 18-34 years old

82% were born in the US

45% have kids in the household

What you need to know about FIFA fans in Canada:

47% of Canadians 13-64 have engaged in the past 12 months

54% among engaged are male

33% are foreign-born

43% live in Ontario

Target efficiency among FIFA engaged

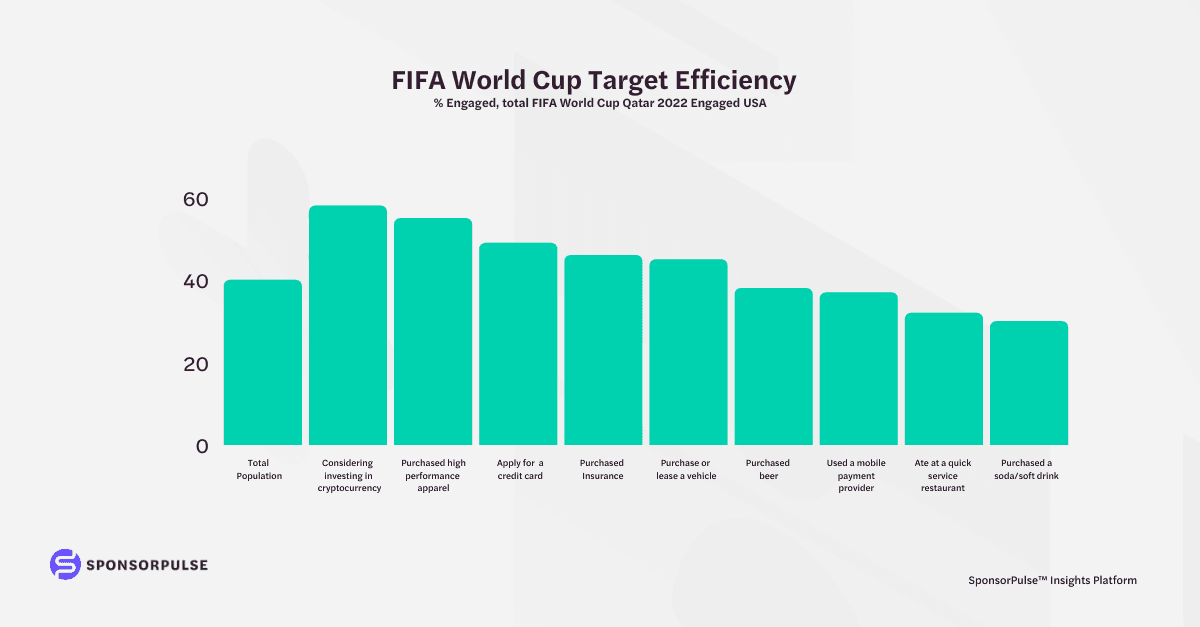

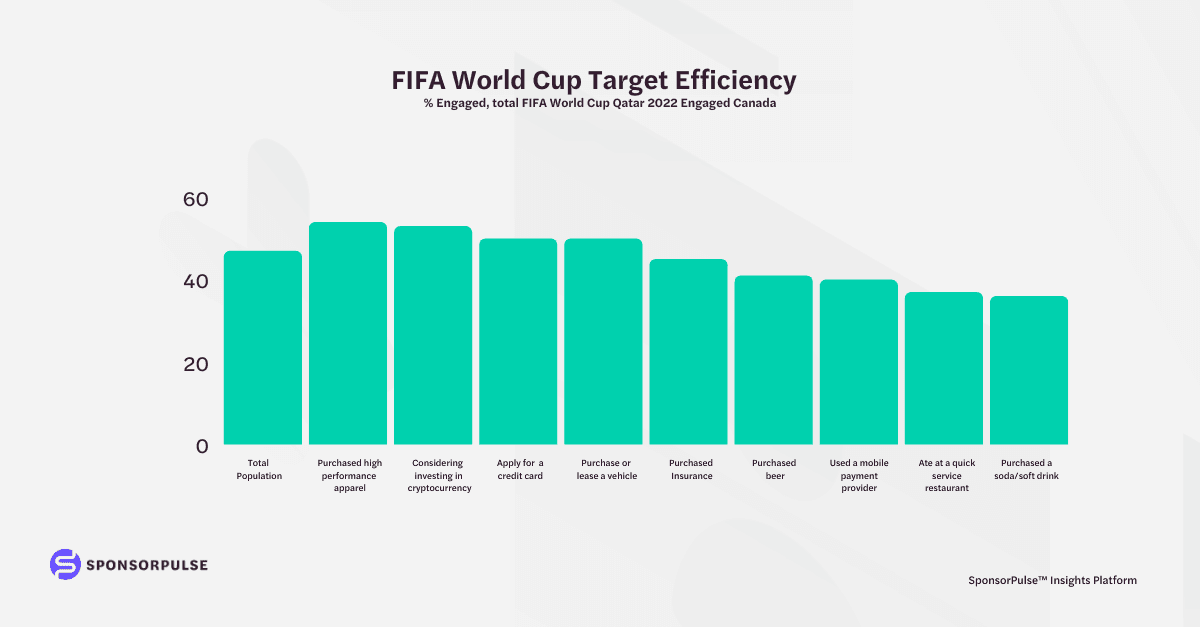

Now that we have an idea of who the FIFA engaged audience is, we can dig deeper into the purchasing categories they are most active in, and therefore the brand categories that can expect to benefit most from a sponsorship.

Of categories that sponsor FIFA In the US, Crypto and high-performance apparel perform the strongest, while quick-service restaurants and soft drinks lag.

While in Canada, high-performance apparel and crypto deliver the strongest target efficiency.

See which brand sponsors won the FIFA World Cup

Leveraging robust consumer data from the SponsorPulse Insights Platform and interviewing thousands of Canadian and US residents, we measured the sponsorship performance and impact across major brands.

Find out which sponsors won the FIFA World Cup. Download your copy today!